DKV health insurance for individuals

Health insurance that offers access to the best private medicine service

-

We will take care of your physical and emotional health.

-

We make all the paperwork easy.

Take out a policy now with a 35% discount.

Discounts for 5 years.

Why choose health insurance with DKV?

More than 2 million customers put their trust in DKV. We have been taking care of your health for over 25 years.

More than 51,000 doctors and 1,000 affiliated centres, 23 own centres and 8 of the best 10 hospitals.

Medical chat and video consultation with specialists wherever you are, offering you the best assistance.

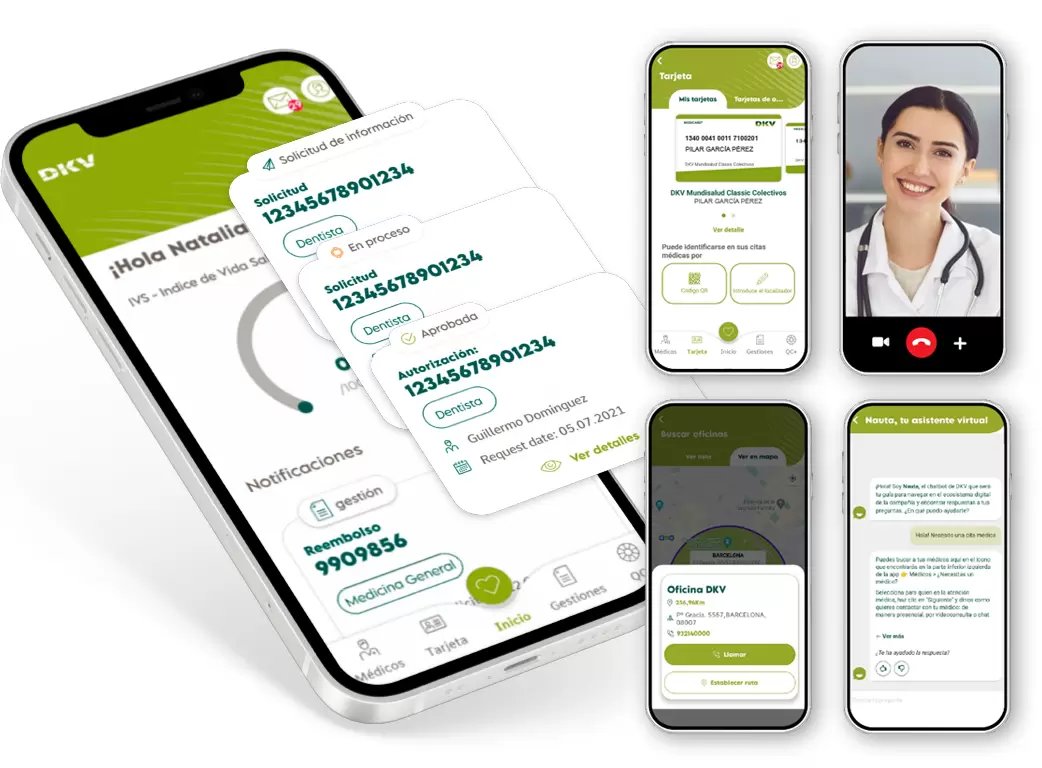

You can request authorisations and medical appointments, access your medical reports or process reimbursements through the app.

Calculate your medical insurance

Fill in the following form:

Health insurance designed for you

At DKV, we offer health insurance that takes care of you at every stage of your life to cover your health needs.

Insurance with copayment

Health insurance with a more economical instalment, and a small amount payable whenever you use the medical service.

Insurance without copayment

Medical directory insurance with a fixed monthly payment, regardless of its use or the times you visit a specialist.

Insurance with a personal doctor

A new medical experience with all the cover of a comprehensive health insurance policy and the reassurance provided by a personal doctor.

Economical insurance

Cheap health insurance suited to every pocket, with reduced cover, without hospitalisation and surgery and with the possibility of personalising the insurance.

Reimbursement insurance

Medical insurance in which you can choose the doctor and hospital centre, and with a reimbursement of expenses in less than a week.

Insurance without waiting periods

Health insurance that you can use from day one, without waiting for visits to specialists or diagnostic tests.

Doctors, centres an own health spaces

51,000 doctors and 1,000 health centres available for you.

DKV medical directory

When you take out health insurance, the medical directory is what you will value most, so that you have the centres you visit near you and you can go to a medical specialist whenever you need it.

At DKV, we have more than 51,000 professionals and 1,000 medical centres available throughout Spain. Avoid waiting lists and long procedures with the security and professionalism of the most convenient, fastest healthcare, and choose whatever you need at any time.

Medical specialities

-

Complete Medical Directory

See medical directory -

Medical specialists

Enjoy access to consultations of over 51,000 medical professionals from day one: general medicine, nursing services, paediatrics, gynaecology, allergology, dermatology, chiropody and traumatology.

-

Clinical analyses

Take laboratory tests to confirm or rule out a medical diagnosis: blood, urine or faeces tests for objective results.

-

Diagnostic tests

Early detection tests, diagnostic tests, preventive or general check-ups prescribed by a specialist.

-

Dental treatments

From preventive dentistry to cosmetic treatments, with DKV medical insurance, you will enjoy dental cover at no additional cost: dental cleaning, sealants or extractions, and other services with great discounts: orthodontics, cosmetic dentistry, etc.

-

Health and wellness services

Access to DKV Club Salud y Bienestar at special prices for being a DKV customer: nutrition, sport, gait analysis, fertility treatments, cosmetic or wellness treatments, among others.

Espacios de Salud DKV

-

Doctors and centres

With DKV Seguros, you can choose from the best range of specialists and medical centres in Spain. We use 8 of the 10 best hospitals in the country.

-

Espacios de Salud DKV

Whether you are a DKV customer or not, we have our own Espacios de Salud , with odontologists and specialists, personalised treatments with high-quality materials and the latest technology, all with your health in mind.

-

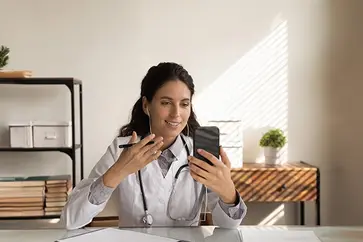

Online consultation with specialists

Unlimited video consultations with a specialist without leaving home, chatting directly to resolve any medical queries at any time of the day. In addition, you will be able to share privately images and documents, as well as receive your electronic prescriptions.

-

Digital midwife and Health coach

Advisory services via a private chat with a midwife if you are pregnant or just gave birth to a baby. If you are looking for help to change your lifestyle habits, you have a health coach service available (diet, sports, tobacco, sleep, etc.)

-

Medical helpline

24-Hour DKV Physician wherever you are, as well as Specialised medical lines: paediatrics, nutritionist, conditions affecting women, pregnancy, childhood obesity, sports medicine and psychoemotional.

Your insurance always with you

Manage your insurance and access digital health services from anywhere with the Activa DKV app.

Do you need help?

If you are thinking about taking out an insurance policy and you have questions, we will answer them in the way you choose.

Visit your nearest agent

Call us

We'll call you FREE OF CHARGE