Gobierno corporativo, ética y gestión de riesgos

Informe Anual 2022

Nuestro modelo de gobernanza responde a las directrices establecidas desde la matriz a través de una serie de políticas y normativas internas que establecen los principios de actuación en materia de cumplimiento, gobernanza y asuntos corporativos. Estas normativas se asumen y adaptan a la estructura y organización de DKV con el objetivo de cumplir con los requerimientos de la Directiva Solvencia II y la Ley de Ordenación, Supervisión y Solvencia de Entidades Aseguradoras y Reaseguradoras (LOSSEAR) y su Reglamento de desarrollo (ROSSEAR).

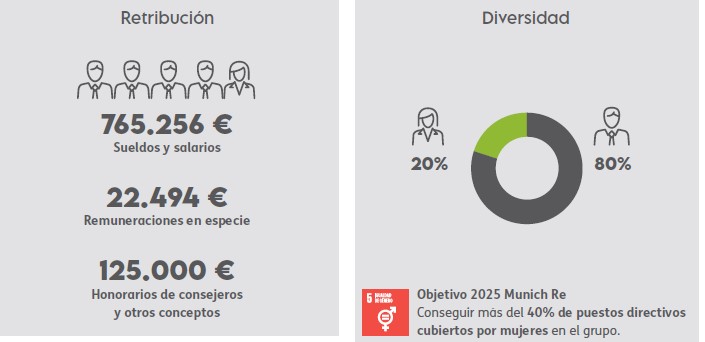

Consejo de Administración

El Consejo de Administración es el órgano de gestión y representación de DKV Seguros y Reaseguros, S.A.E. y está compuesto por entre tres y doce consejeros. Estos son designados o reelegidos por la Junta general, cumpliendo con las exigencias de aptitud y honorabilidad definidas en Solvencia II, ejercen sus cargos por un período de seis años y pueden ser reelegidos una o más veces por idéntico periodo.

Principales funciones

-

Gestionar, representar y ejercer todos los derechos y asumir las obligaciones relacionadas con la actividad legal y económica de la compañía.

-

Definir y realizar el seguimiento y gestión de la estrategia.

-

Aprobar anualmente las políticas corporativas y normas de primer nivel, así como el informe de gobierno corporativo, las cuentas anuales, y el informe de gestión que incluye el estado de información no financiera.

-

Nombrar a un presidente, un secretario y un consejero delegado y establecer los comités que considere necesarios.

Responsabilidad en la gestión de la sostenibilidad

El Consejo es responsable de la aprobación de los planes estratégicos y de negocio responsable que impactan en cuestiones ambientales y sociales, además de otros marcos clave como el código de conducta y la definición de los valores y compromisos de DKV.

El consejero delegado y el presidente aprueban los contenidos del presente informe con el objetivo de garantizar que se incluyen los temas materiales identificados anualmente. Por su parte, el consejero delegado también forma parte del Comité de negocio responsable de DKV. En cuanto a la información al Consejo sobre el desempeño en sostenibilidad, destacan los siguientes procedimientos:

-

El sistema de gestión ética establece que el Consejo sea informado a través del responsable de cumplimiento normativo de todos los temas críticos en relación con la ética que puedan surgir internamente.

-

De manera trimestral, el Consejo recibe actualizaciones del desarrollo del plan de sostenibilidad y reputación.

-

Actualizaciones periódicas de los indicadores clave de la compañía, incluyendo métricas de sostenibilidad y reputación.

-

Presentación de un estudio anual de reputación, que incluye la visión del desempeño en sostenibilidad por los principales grupos de interés.

Las personas miembros del Consejo son expertas en temas sociales, éticos y medioambientales desde una perspectiva especialmente referida a los retos del sector asegurador en España, que suele tratarse en las diferentes reuniones del Consejo.

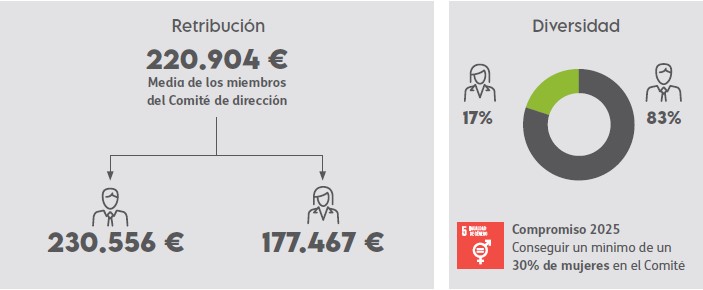

Comité de dirección

Órgano cuya misión es definir, vigilar y conducir las estrategias y líneas de acción del Grupo DKV. El Comité de Dirección está orientado a la consecución de los objetivos financieros y no financieros establecidos por el Consejo de Administración, con la finalidad de asegurar la continuidad de la empresa en el largo plazo. Está presidido por el consejero delegado, Josep Santacreu.

Principales funciones

-

Gestión y representación, obligaciones legales y económicas del Grupo.

-

Fijar el marco estratégico y garantizar su comprensión.

-

Evaluar el cumplimiento de los objetivos estratégicos.

-

Crear una organización efectiva y eficiente.

-

Desarrollar el talento y el liderazgo.

-

Definir y potenciar la cultura corporativa.

Toma de decisiones

El Comité de Dirección se reúne con la frecuencia que estime apropiada el Consejero Delegado, preferentemente quincenalmente. Las reuniones se realizan de modo presencial o por teleasistencia, alternando entre las sedes de Barcelona y Zaragoza. La toma de decisiones se realiza, en la medida de lo posible, por consenso.

Cuando no hay una postura unánime o existe un conflicto que afecta al núcleo de negocio, el Consejero Delegado tiene la responsabilidad de decidir.

En casos urgentes, las decisiones se pueden tomar por escrito y sin sesión, en forma circular, (en el sentido establecido por el artículo 248.2 de la Ley de Sociedades de Capital), es decir, sin celebrar sesión del órgano, sino mediante votación separada de sus miembros, por ejemplo, por correo electrónico.

Derechos humanosLa política de DDHH de DKV sigue las directrices de la matriz Munich Re y está detallada en el Código de Conducta del Grupo, adoptado por DKV. Se basa en el compromiso de respetar los derechos humanos a lo largo de toda la cadena de valor y a respetar los derechos humanos internacionalmente reconocidos. DKV es una de las empresas fundadoras de la Red Española del Pacto Mundial. A través de esta adhesión, nos comprometemos a apoyar la protección de los DDHH en nuestro ámbito de influencia; tomar precauciones para garantizar no ser cómplices de abusos; defender la libertad de asociación y el reconocimiento efectivo del derecho a la negociación colectiva; evitar todas las formas de trabajo forzoso e infantil; procurar proporcionar empleo y lugares de trabajo que estén libres de discriminación. |

ética e integridad

La gestión ética busca asegurar la excelencia profesional y corporativa en DKV. Entendemos la ética como el comportamiento de las personas y su responsabilidad personal, que se evalúa como parte de su desempeño profesional.

La compañía cuenta con mecanismos de lucha contra el soborno y la corrupción, así como un sistema de evaluación, control y mejora de la gestión de la ética empresarial que se actualiza de forma continua para su adaptación a las exigencias del marco normativo interno y externo.

En 2022, destaca la implementación de las siguientes novedades para reforzar nuestro compromiso ético:

1. Aprobación o modificación de políticas para adaptarnos a los estándares establecidos por la matriz en relación con el sistema de gestión de cumplimiento y a Solvencia II:

-

Política para la creación de normas

-

Política de idoneidad

-

Normativa de inversión responsable

-

Política de gestión de capital

-

Política de gestión de riesgos

-

Política de externalización

-

Política de continuidad de negocio

-

Procedimiento de investigaciones internas y protección del denunciante

-

Política de remuneración

-

Política ORSA

-

Política NPP

-

Normativa sobre gestión del riesgo reputacional

-

Política de comunicación de crisis

-

Normativa sobre el uso de información privilegiada

2. Acciones formativas para toda la plantilla sobre el Código de Conducta, Prevención de blanqueo de capitales, privacidad y seguridad de datos personales, sostenibilidad y cambio climático, así como sobre las principales materias de cumplimiento para las nuevas incorporaciones en la compañía.

DKV es una de las empresas fundadoras de la Red Española del Pacto Mundial.

A través de esta adhesión se compromete a difundir y contribuir a los 10 principios del Pacto Mundial de Naciones Unidas y a los Objetivos de Desarrollo Sostenible (ODS).

DKV dispone de canales internos y externos para que los grupos de interés puedan denunciar casos de posibles violaciones de los derechos fundamentales.

4 Canales de denuncia

Responsable de cumplimiento

denuncias recibidas

0

posibles violaciones a derechos humanos

Gestión sostenible de los riesgos

DKV ha desarrollado un sistema de gestión de los riesgos con el objetivo de analizar e informar a los órganos de gobierno sobre la evolución de los riesgos a los cuales está expuesta la compañía. Este sistema está formado por las funciones de gobierno corporativo que establece el segundo pilar de Solvencia II para una gestión integrada de los riesgos.

La evaluación interna anual de riesgos y solvencia, así como los informes trimestrales de riesgos correspondientes al segundo y cuarto trimestre de cada año, se someten a discusión en el Consejo de administración, responsable último de la gestión de riesgos, para valorar los impactos potenciales, riesgos y oportunidades.

Por su parte, el Comité de dirección es el responsable de la gestión de los riesgos en la actividad diaria del negocio, salvo aquellos asociados a las inversiones financieras. Los riesgos asociados a la suscripción de negocio, operacionales, reputacionales y estratégicos deben ser evaluados y gestionados en este órgano de decisión.

PRINCIPALES RIESGOS IDENTIFICADOS

En la identificación de riesgos, analizamos los factores internos y externos que puedan influir en la consecución de los objetivos estratégicos. El diálogo con los grupos de interés es un elemento importante a la hora de detectar riesgos y oportunidades.

Principales riesgos asociados al sector asegurador

Riesgo |

Definición |

Gestión |

|

Envejecimiento de la población |

En un contexto de envejecimiento de la población, surge la oportunidad de dar respuesta a las nuevas necesidades emergentes asociadas al bienestar y la salud. |

Lanzamiento de productos aseguradores con componente social, aumento de la edad de contratación, e iniciativas de prevención para nuestros asegurados. |

|

Evolución del sector sanitario privado y el marco regulatorio de la sanidad

|

Un factor de riesgo clave es la evolución del sector sanitario privado y el marco regulatorio de la sanidad. |

Monitorización activa de cambios en el marco regulatorio. |

|

Monitorización activa de cambios en el marco regulatorio. |

La mejora de la esperanza de vida registrada en las últimas décadas es una excelente noticia, pero conlleva importantes desafíos sociales, económicos y financieros |

Adaptación a nuevas tablas de mortalidad sectoriales. |

Principales riesgos externos

Riesgo |

Definición |

Gestión |

|

Factores ambientales |

Los factores de riesgo ambientales tienen una influencia directa en la salud de las personas. Destaca la contaminación atmosférica, que agrava enfermedades asociadas al sistema respiratorio, aumentando el uso de las urgencias hospitalarias y el consumo de fármacos. |

Concienciación a nuestros grupos de interés a través de publicaciones como el Observatorio DKV de Salud y Medioambiente. |

|

Cambio climático

|

El cambio climático supone una amenaza para la salud y seguridad de las personas. Destacan como posibles efectos: 1.- Aumento de olas de calor, polución atmosférica, extensión geográfica y estacional de la transmisión de enfermedades infecciosas, así como el aumento de la probabilidad y la gravedad de epidemias y pandemias. De producirse alguno de estos riesgos, significaría un incremento sobre la siniestralidad de la cartera de salud en forma de hospitalizaciones y de las carteras de decesos y vida por aumento de fallecimientos debido al calor extremo. 2. - Aumento de la frecuencia y concentración de eventos meteorológicos extremos y catástrofes naturales. Tendría un impacto en la siniestralidad de la cartera de hogar debido al aumento de posibles daños. |

Existen diversos elementos que contribuyen a mitigar el impacto de dichos efectos ambientales, como el Consorcio de Compensación de Seguros, el reaseguro o las campañas de prevención. Estrategia de cambio climático 2030: Planeta Salud. |

|

Operacionales |

Posibles fallos en los procesos de gestión en seguros con un nivel de especialización como salud afectan negativamente a la relación con el cliente. |

Sistema de Control Interno configurado a través de un procedimiento de evaluación de puntos de control de riesgo operacional asociados a procesos. Cooperación de las funciones de gobierno corporativo en la identificación y monitorización de riesgos operacionales, de cumplimiento normativo o de sistema de gobierno. |

|

Reputacionales |

Especialmente relevantes con la implantación del teletrabajo y el avance significativo en la digitalización de la compañía. |

Política de ciberseguridad. Procedimiento de gestión de incidencias y respuesta ante incidentes de seguridad. Plan anual de refuerzo de concienciación a la plantilla. |

Política de inversión prudente

Los Principios para la Inversión Responsable (PRI por sus siglas en inglés), de los cuales Munich Re –nuestro último accionista- fue miembro fundador, proporcionan el marco fundamental para el enfoque de inversión sostenible de nuestro Grupo.

Estos principios tienen como objetivo mejorar la comprensión de las implicaciones ambientales, sociales y de gobierno corporativo de las inversiones y ayudar a los signatarios de PRI a integrar estos temas en sus decisiones de inversión. Munich Re no solo informa a PRI, sino que también lo involucra en un diálogo fructífero para desarrollar aún más su propia estrategia ESG en línea con los últimos desarrollos.

Para fortalecer aún más el compromiso con esta causa, MEAG, la filial del Grupo que gestiona nuestras inversiones financieras, también se adhirió a PRI en 2021. Sobre la base de PRI, el Grupo tiene una Directriz de Inversión Responsable (RIG) vinculante para todo el Grupo, que cubre todos los requisitos PRI y ESG relacionados con la gestión de inversiones del Grupo, incluidos criterios vinculantes de exclusión de inversiones.

Nuestro Grupo está convencido de que la integración de los criterios ESG en las decisiones de inversión contribuye a una gestión de riesgos mejor y más holística de los activos que poseemos. La medición del cumplimiento de esos criterios ESG en nuestras carteras de inversión se realiza en base al rating ESG asignado por MSCI a cada uno de los activos en cartera. El rating promedio de nuestra cartera de inversión a 31 de diciembre de 2022 era “A” (en un rango que va desde la C –peor calificación- hasta la AAA –mejor calificación-).